Get the free st 119 form pdf

Show details

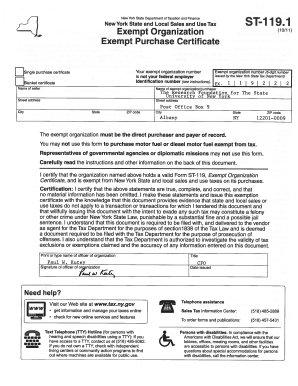

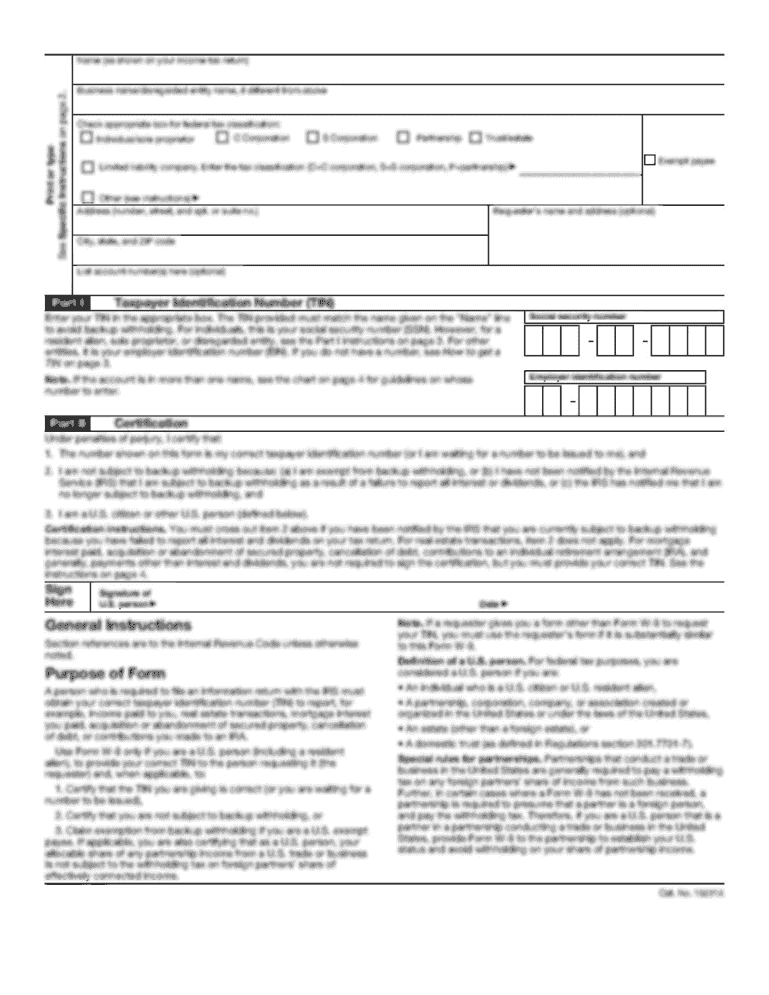

ST-119.2 New York State and Local Sales and Use Tax Application for an Exempt Organization Certificate (11/08) State and Local Sales and Use Tax Name of organization Address (number and street) City,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your st 119 form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 119 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st 119 form pdf online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit st 119 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out st 119 form pdf

How to fill out the ST 119 form?

01

Start by obtaining the ST 119 form from the relevant source, such as the tax department's website or local tax office.

02

Carefully read the instructions provided with the form to understand the required information and any specific guidelines.

03

Begin the form by providing personal information, such as your name, address, and social security number, as requested.

04

Proceed to fill in the income-related details, including sources of income, deductions, credits, and any other relevant information.

05

Double-check all the information you have entered to ensure accuracy and completeness.

06

Sign and date the form as required, and attach any necessary documents or supporting evidence, as mentioned in the instructions.

07

Review the completed form once again before submission to ensure you have provided all the required information and signatures.

Who needs the ST 119 form?

01

Individuals who are required to report their income and pay taxes to the relevant tax authority.

02

Self-employed individuals or freelancers who need to declare their business income.

03

Individuals who have received income from multiple sources, such as investments, rental properties, or government benefits.

04

People who have earned income in a state where they do not reside, and therefore need to file non-resident tax returns.

05

Individuals who wish to claim certain deductions, credits, or exemptions, as specified in the tax laws.

Please note that the requirements for filing the ST 119 form may vary by jurisdiction, so it is essential to consult the specific tax regulations and guidelines applicable to your situation.

Fill tax exempt form 2018 st 119 1 : Try Risk Free

People Also Ask about st 119 form pdf

Who is exempt from NY state income tax?

What is exempt from NYC sales tax?

What is NY ST 120 form?

What is an ST 4 tax exempt form for in NJ?

What is the tax exempt form for non for profit NYC?

What is the tax exempt form for NYS?

How do I get sales tax exemption in New York?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is st 119 form?

The ST-119 form is a New York State sales tax exemption certificate. It is used by businesses and organizations to claim exemptions from certain sales and use taxes on purchases made for specific purposes, such as reselling the items, manufacturing, or qualifying nonprofit activities. The form is typically provided to vendors to prove the eligibility for a sales tax exemption and avoid paying sales tax on qualifying purchases.

Who is required to file st 119 form?

The ST-119 form is specific to the state of New York and is used for documenting taxable sales made to exempt organizations. It is required to be filed by vendors who make sales to exempt organizations, such as certain nonprofit organizations, educational institutions, and government entities.

How to fill out st 119 form?

To fill out Form ST-119, you can follow these steps:

1. Obtain a copy of Form ST-119: You can visit the website of your state's tax department or contact them directly to request a copy of the form. Alternatively, you may be able to find a fillable PDF version of the form online.

2. Enter your personal information: Provide your name, address, and other relevant identifying details at the top of the form.

3. Check the appropriate box: Determine the reason for filling out the ST-119 form. There will be a series of checkboxes indicating different scenarios (e.g., purchasing items for resale, purchasing items exempt from sales tax, etc.). Select the box that best applies to your situation.

4. Provide a detailed description of the items purchased: In the next section of the form, you will need to list the items you purchased that are eligible for exemption or resale. Include a description of each item and its corresponding dollar value.

5. Calculate the total exempt or resold amount: Add up the total dollar value of the items listed in the previous step and enter it in the designated field.

6. Sign and date the form: Verify that all the information provided is accurate and complete. Then, sign and date the form at the bottom.

7. Submit the form: Determine the method of submission specified by your state's tax department. It may require mailing the form to a designated address, submitting it electronically, or using an online portal. Follow the instructions provided to ensure your form is properly submitted.

Remember, each state has its own version of Form ST-119, so the specific instructions may vary. It is crucial to refer to the instructions accompanying the form for accurate guidance on how to fill it out.

What is the purpose of st 119 form?

Form ST-119, also known as the New York State Sales Tax Exemption Certificate, is a document used by businesses or individuals to claim exemption from paying sales and use tax on certain purchases. The purpose of this form is to provide evidence to sellers that the purchaser qualifies for a sales tax exemption, based on their specific eligibility criteria stated in the form. By providing this completed and signed form to the seller, the purchaser does not need to pay sales tax on their eligible purchase.

What information must be reported on st 119 form?

The ST-119 form is a New York State sales tax exemption certificate. It is used to claim an exemption from sales tax for certain purchases. The information that must typically be reported on the ST-119 form includes:

1. Purchaser Information: Name, address, and contact information of the person or organization making the purchase.

2. Vendor Information: Name, address, and contact information of the seller or vendor.

3. General Description of Property or Service: Briefly describe the property or service being purchased and the reason for the exemption.

4. Reason for Exemption: Indicate the specific exemption category that applies to the purchase, such as resale, manufacturing, agriculture, etc.

5. Identification Numbers: Provide the purchaser's New York State sales tax identification number, if applicable.

6. Signature: The form must be signed by an authorized representative of the purchaser certifying the accuracy of the information provided and the eligibility for the claimed exemption.

It is important to note that specific requirements may vary depending on the circumstances and the type of exemption being claimed. It is recommended to consult the official instructions and guidelines provided with the ST-119 form or contact the New York State Department of Taxation and Finance for any specific questions or clarifications.

When is the deadline to file st 119 form in 2023?

I apologize, but I'm not able to provide specific deadline information for filing a ST 119 form in 2023 as it depends on the country and specific tax regulations. I recommend contacting your local tax authority or a tax professional for accurate and up-to-date information regarding the deadline.

How can I modify st 119 form pdf without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like st 119 form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I edit st119 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign st119 form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete st 119 fillable form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your st119 1 fillable form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your st 119 form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

st119 is not the form you're looking for?Search for another form here.

Keywords relevant to st 119 tax form

Related to st119 nys

If you believe that this page should be taken down, please follow our DMCA take down process

here

.